ATO Changes Rules on Common Trust Distributions

On 23 February 2022 the ATO targeted the tax benefits of family trust distributions with a focus on distributions to the adult children of trust controllers. It’s one of the most significant developments for the taxation of trusts in over two decades. The ATO’s attack on the potential tax benefits of trusts is comprehensive:

• Draft Taxation Ruling TR 2022/D1 Income tax: section 100A reimbursement agreements

• Draft Practical Compliance Guideline PCG 2022/D1 Section 100A reimbursement agreements – ATO compliance approach

• Draft Taxation Determination TD 2022/D1 Income tax: Division 7A: when will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?

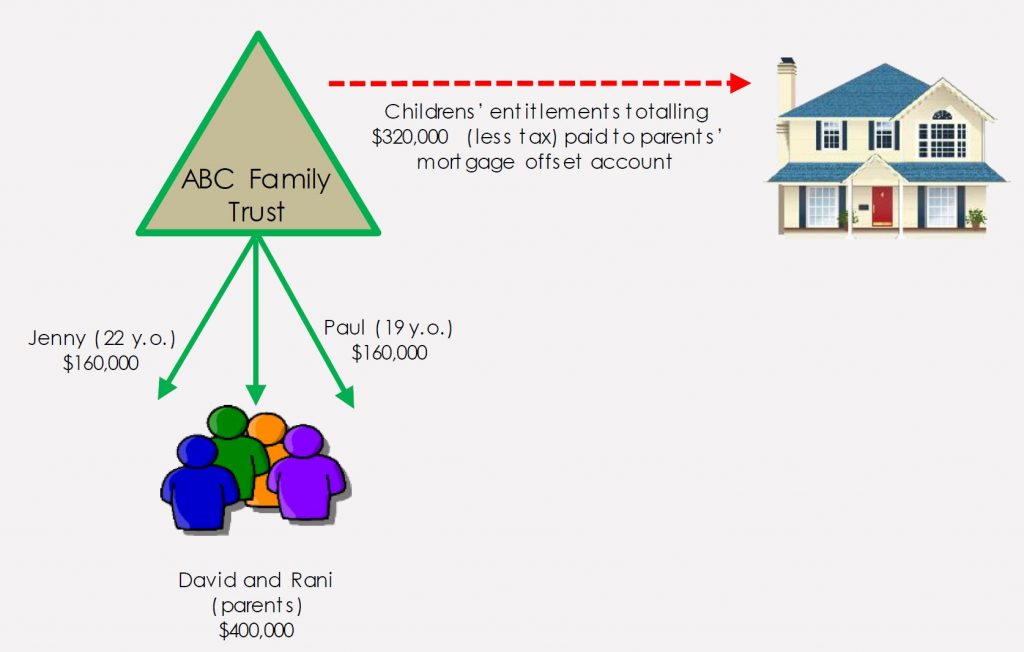

• Taxpayer Alert TA 2022/1 Trusts: parents benefitting from the trust entitlements of their children over 18 years of age

Background

In 1979 section 100A was added to the tax law so that a “reimbursement agreement” for a trust distribution would not be tax effective except if entered into “in the course of ordinary family and commercial dealings”. For 40 years, common industry practice was that where a trust distribution to an adult child was used for the benefit of their parents that fell within the terms of an ordinary family dealing. The ATO released some guidelines in 2014, however by its continued inaction the ATO indicated they were not going to challenge the issue.

On 23 February 2022, some 43 years after the legislation was enacted and 8 years after their 2014 guidelines, the ATO has expressed their apparently long held view that while distributions to adult children may be wide spread and common, it is not an ordinary family dealing and the ATO may challenge this practice as a reimbursement agreement and apply retrospective tax, interest and penalties.

So what are the ATO targeting?

The ATO says that arrangements that it is targeting usually have some or all of the following features

• a discretionary trust is controlled by one or two individuals (either personally or via a corporate trustee) and those individuals are parents in a particular family unit;

• income derived by the trust is used to pay the parents’ expenses, including by debiting / crediting loan accounts;

• trust resolutions appoint income to adult children beneficiaries;

• adult children purportedly receive distributions. However, those distributions generally do not exceed $180,000 (inclusive of the children’s other income);

• the children do not actually receive any amounts from the trust; and

• amounts are instead used by parents to set-off obligations from when the children were minors (school fees, etc) and /or used to satisfy general family expenses and / or the parents’ personal obligations.

The ATO position is that parents who make trust distributions to their adult children and arrange for their children to give the distribution back to them are doing this to reduce tax. The ATO plans to invalidate the trust distribution and tax the trustee of the trust at 47% on the amount of the distribution, and they may charge penalties on this as well.

The application of the new approach is slated to commence from 2014 onward. The tax profession considers this change in approach is either invalid, or if valid it should apply from 2022 onward rather than retrospectively.

As a general rule, Porters CA has recommended a conservative approach of distributing to adult children amounts that are reflective of actual funds provided to them or expenditure incurred on their behalf. However all circumstances are different and to provide assurance we recommend review of your specific circumstances.

Our plain English description of the ATO rulings:

• Money should follow the distribution – when a distribution is made to a family member they must get the benefit of it.

• Where a distribution is made to adult children and the money is paid to them and given back to their parents, used on behalf of the parents or the child’s entitlement is forgiven or otherwise transferred to their parents, that is a reimbursement agreement and may attract ATO attention.

• The ATO have a concept of “ordinary parental expenses”. In essence, all expenses before a child turns 18 are ordinary parental expenses and can’t be accumulated as an amount the child owes to the parents or to a trust. Before turning 18 a minor is not able to agree for their parents to spend money on their behalf for later repayment.

• The ATO have specifically addressed a washing machine where a trust distributes to a company that pays a franked dividend in the following year back to the trust which then distributes to the company thereby deferring and avoiding tax. Rinse and repeat. This is an artificial approach we have avoided with our clients so we expect few issues.

• The rulings are focused on parents and children, however the same concept applies for distributions to other family members and for adults distributing to their elderly parents.

• The ATO has provided an example where an adult child has university fees and expenses paid by the trust on their behalf. Where funds are provided to the child or applied on their behalf that falls within the ATO guidelines and remains acceptable. If you are giving your adult child money, or directly paying expenses on their behalf, that remains acceptable. We recommend that in these cases your children are fully informed of your actions and the tax and trust implications.

As a result of these ATO rulings your options to distribute trust income across your family members will need to be supported by more detailed documentary tracking of cash transfers and payments to or on behalf of your adult children or family members. The ATO are signalling that their approach is changing from a passive to an active review of tax reduction via family trusts.

In positive news, and which is the position for the vast majority of our clients, the ATO accepts that a spouse is generally an eligible beneficiary of trust income distributions and would rarely be caught by these provisions.

The devil is always in the detail. The ATO position is set out in the four documents we linked above and includes detailed analysis and examples – we recommend that you read them, however we would also understand if you choose not to…

ATO “attack” on Trusts

For many years, it has been common practice for business owners and investors who use Family (Discretionary) Trusts to look to spread trust income across family member beneficiaries.

Trust distributions are often made to adult children for asset protection and estate planning purposes.

Sometimes, the adult children in a family may have lower tax rates than their parents, so the overall tax rate for the family group is lower as a result of the spread of these trust distributions. The ATO would like to see this tax reduction stop.

The ATO have also expressed a concern in the situation where a trust makes a distribution to a related entity, such as another trust, that has a current year or carried forward loss. This has had less specific attention in the ATO draft guidelines however we are watching this issue closely.

How Does This Impact You?

Tax laws change all the time, and it’s our role as your accountants and advisors to keep you alert to important changes that affect you.

There are different levels of risk associated with different tax planning strategies that involve trust distributions.

The ATO has classified these risks as white zone, green zone, blue zone and red zone. The ATO will potentially investigate all red zone risks and some blue zone risks and will not investigate the white and green zones.

We want to help you to understand how these ATO tax law changes affect you, discuss new strategies that you might be able to use, and assist with your year end planning and estimate your tax payable for 2022 and 2023 so you can plan for it.

Our assistance will give you peace of mind that the way you are using your Trust will satisfy the ATO and not draw audit attention to yourself.

These new guidelines are Draft and subject to review and feedback. In parallel the ATO are currently appealing a recent Federal Court decision, the Guardian case, where the Court’s views was not aligned with the ATO’s current position. We need to strike a balance between reviewing and protecting your position while waiting for a final ATO position to be determined. The timeline between Draft and Final guidelines is not known, however once finalised we expect the ATO will backdate the application of final guidelines to their 23 February announcement date.

Our Plan To Help You

We recommend:

1. Review your historical trust distributions.

2. Review your current 2022 estimated taxable income for your entire family group, including all companies and trusts you have.

3. Provide you with an “Estimated Tax Payable” with trust distributions in the “green zone”, without breaching any of the new ATO draft rulings.

4. Meet with you to discuss your options for 2022 tax planning.

Please note that this is initial advice for your 2022 tax planning to advise you on the new ATO Tax Rulings and how they affect you.

After the 2022 Federal Budget on 29 March 2022 and the Federal Election expected shortly thereafter, we expect we will need to revisit and finalise your tax planning advice for 2022 to incorporate a year end trading update and further Government announcements.

Advice on your position should be tax-deductible and is a small amount to pay to ensure that the ATO won’t target you and to ensure that you can carefully plan for your expected 2022 and 2023 tax payments.

Next Steps

If you would like to proceed with a preliminary review, please email us and let us know that you would like us to prioritise getting started on your 2022 Tax Planning.

We look forward to hearing from you soon and we look forward to helping you manage this disruption from the ATO.