Navigating the Unpredictable: Mastering Risk Management

How many things can go wrong? We don’t have an exact number, but at a guess, quite a lot. Enough to take notice and manage risk as a process and with intent. Not so many that we need to wrap ourselves in cotton wool and stay indoors.

What have we seen in recent years?

This is probably not the full list, but it’s a pretty good start:

- Payment sent to a hacker due to email hack altering supplier bank account details

- Personal injury

- Relationship breakdown

- Loss of key staff

- Serious health issues including death

- Home fire

- Business premises fire

- Interest rate rises

- Covid lockdowns

- Stolen cars

- Hail and storm damage

- Fraud and theft by internal staff

- Fraudsters impersonating the ATO

- Cyber crime and crypto locker scams

- Motor vehicle accident

- Business break in with theft and shopfront glass damage

- Incorrect timing and documentation on super contributions resulting in lost deductions

- Business insolvency

- Contract dispute

- Contract termination for convenience

- Bad debts

- Unfair dismissal claims

- Intellectual property theft by employees

- Investment losses

- Faulty materials

- Building delays and cost escalation

- Negligence claims

Does this mean we’re on the lookout for things to go wrong? Well yes and no. We’re always on the look out to identify and manage issues before they go wrong, but we’re equally committed to identifying ways to proactively prevent risks and minimize losses.

Risks are always present in business or in life. We can avoid some, mitigate others, create contingency plans, get insurance cover. And some risks just happen out of left field and our constructive reaction is what makes the difference.

So how would you analyse your risks?

A risk analysis process involves identifying potential risks and issues that could impact a business or your life. The process typically includes the following steps:

Identify existing risks by brainstorming.

Evaluate risks by pinpointing potential issues.

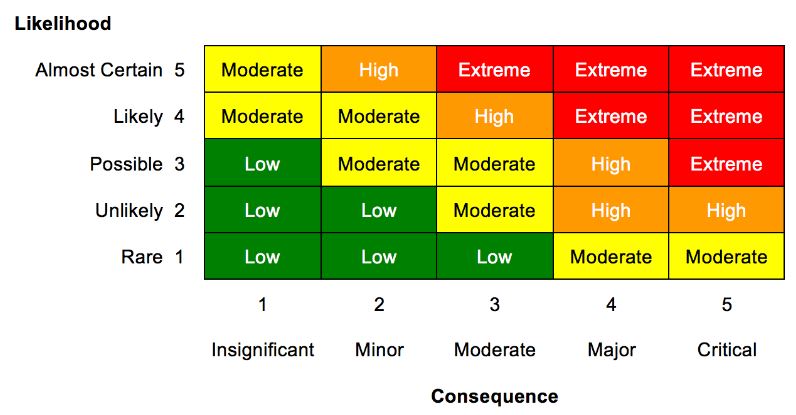

Assess the likelihood and consequences using a table like that below.

Develop an appropriate response. You might be happy to accept the Low level risks whereas an Extreme risk needs a plan (and fast!).

- Accept

- Avoid

- Mitigate

- Implement better systems

- Insure

- Invest in risk reduction or risk management

- Exit – the risk is too high

Develop preventive mechanisms for identified risks. These can be grouped into soft controls (training and behaviour), hard controls (engineering and systems) and mitigations (insurance and alternative plans). After you have implemented preventive actions assess your risk again – have you reduced the risk to a level you’re comfortable with?

Risk analysis is an ongoing process that gets updated when necessary. Circumstances change, so put it in your calendar to review from time to time. Although many risks result in adverse effects, be aware that some risks can also be viewed as unexpected and unplanned for events which create gain and opportunity. Buying a Lotto ticket brings a high risk of loss (which we usually Accept) but with a low likelihood and high consequence chance of winning.

So what next?

Review your risks. Consider documenting in a risk register. Share the details with your colleagues and family.

Review and update your insurance cover.

Prioritize addressing high and extreme risks promptly.

Remember the wisdom behind sayings like ‘never let a crisis go to waste‘ and ‘every cloud has a silver lining.’

When unexpected and unfortunate events happen you can get upset or look for the opportunities presented to do something different. You are not the first, you won’t be the last, but with better risk management you can make sure it is less likely to happen to you or when it does, your life and business can continue uninterrupted.