Labor’s planned changes to negative gearing and capital gains tax

You would have been hearing a little about Labor’s proposed changes to negative gearing and CGT over the last couple of months. So with the election just a few short weeks away, here’s a summary of what the changes might look like.

Currently…

Negative gearing of an investment property occurs when the annual costs (interest, management fees, repairs and maintenance, depreciation, etc) are greater than the net rental income.

Any loss can be deducted from other income, reducing the investor’s taxable income in that financial year.

Investors who sell an asset are liable to pay tax on the capital gain at their marginal tax rate. Investors who hold an asset for longer than 12 months are entitled to a 50 per cent discount.

In a declining property market, despite paying less tax a loss is still a loss, however in a rising market, the CGT discount on the gain in property price creates a tax effective investment for wealth creation.

What’s been proposed by Labor?

If elected, Labor’s proposed tax policy has two parts:

- To limit negative gearing against wage and salary income to newly constructed housing only.

- The capital gains tax (CGT) discount will reduce from 50% to 25%.

Some important things to note:

- Under Labor’s proposal, all investments made before the changes come into effect will be fully “grandfathered”, which means investors who own existing properties before the commencement date will still be able to claim losses against wage income.

- After the commencement date of Labor’s proposed changes, while you can’t claim losses from investments against wage income, losses can still be offset against other investment income such as share dividends, or carried forward to offset the capital gain on the property when it is sold.

- Labor’s proposed CGT changes will be grandfathered for all assets held before 1 July 2020.

With tax planning and investment advice we expect clients of Porters CA will continue to have options and solutions for the future.

Property Market Outcomes?

We don’t have a crystal ball and many factors play into future market movements, however, all else being equal we expect the following:

Price

Labor’s policy would lower property prices in the short term, but some of this has already been “priced in”, meaning much of this fall has already occurred as investors predicted that Labor’s policies were likely to become law. The fall is likely to be in the range of a further 1 to 2 per cent with a bigger impact in areas with a higher proportion of investors.

Rents

Labor’s policy will have little impact on rents. Investors no longer buying established properties because they cannot take advantage of tax breaks would mainly be replaced by renters looking to buy. Landlords have to follow the market to lease a property so a loss in tax offsets won’t result in pricing power to increase rents to generate a desired return.

Because Labor’s policies are grandfathered, investors currently using negative gearing would not lose their tax benefit, so few will rush to sell their properties and may in fact hold onto their investments to keep their tax benefits.

Housing construction

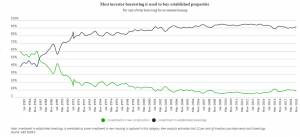

Currently 90% of property investments are in existing properties. Overall, the ongoing impact of Labor’s policy should be positive for housing construction as tax benefits are targeted to new builds. This may be good news for businesses focused on construction of news houses and apartments.

Conclusion

It’s impossible to be certain about the exact impact of Labor’s proposed changes to negative gearing and CGT, but based on the best modelling and predictions, property prices would fall a further couple of per cent, there would be little impact on rents and construction activity should improve in the long term.

Labor’s proposed changes to negative gearing and the CGT discount should not send property prices crashing or rents soaring unless the market is moved by broader forces.

What to do?

As far as property investments are concerned, focus on facts and what is in your control.

Investments must make sense commercially first. After that, we optimize tax outcomes. Investments made solely for tax reasons rarely turn out well and are subject to tax policy risks outside of our control – like election results!

Personal decisions should focus on prosperity; building wealth, providing security and personal health, happiness and wellbeing.

At Porters CA we can’t read the future, but rest assured that we are considering the risks of various tax changes to our clients. We do our best to identify where you are coming from and how best to help you – please contact us if you want to talk about how we can help you better.